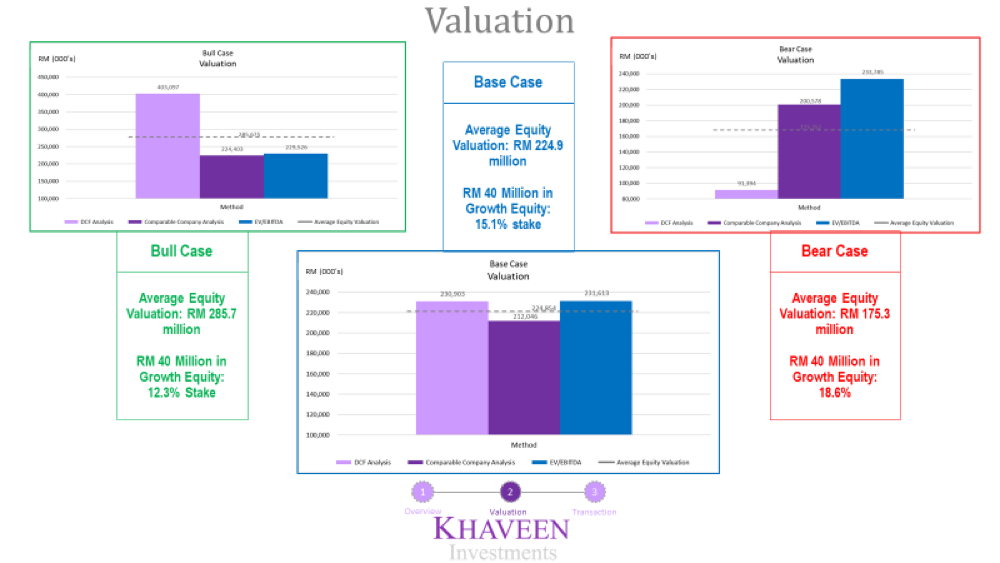

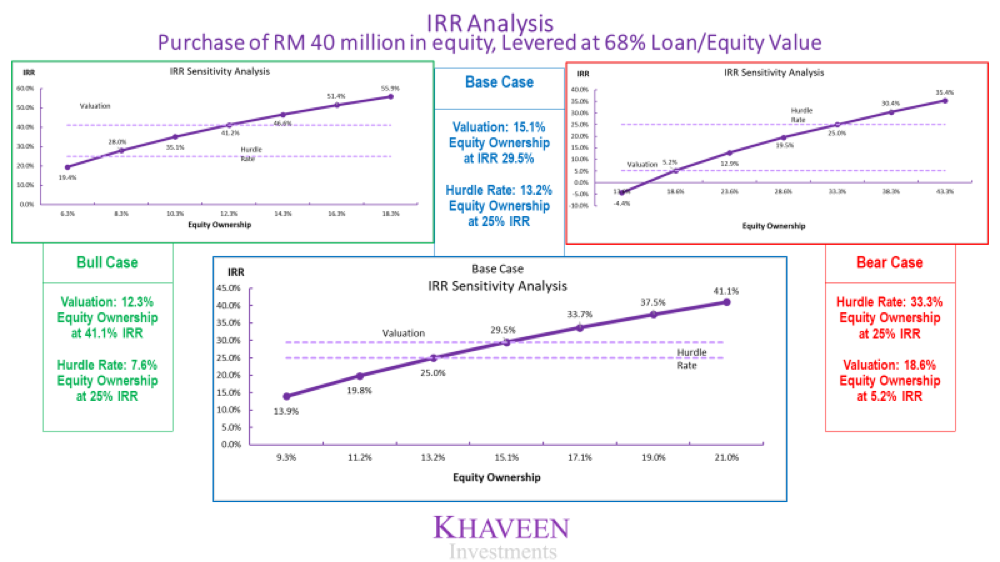

We utilize an arsenal of valuation techniques including Discounted Cash Flow (DCF) valuation, market comparable valuation, precedent transaction valuation, residual income valuation, and liquidation valuation, to independently determine the value of your business. Whether you are looking to value your business for equity financing, Mergers & Acquisitions (M&A), offer for sales, MBO or Initial Public Offering (IPO), we have the expertise to accurately derive the financial value of your company.

In the process of our valuation, we conduct detailed research and analysis of your business and industry to determine the most appropriate valuation with the will to maximize the value of our client’s business and maximize shareholder return. Our valuation reports can be utilized to:

- Determine the fair value of your business for equity financing, M&A transactions and pre-IPO funding

- Determine the approximate value of marketable assets in the event the business is liquidated.

- Establish an approximate value of each owner’s interest for personal planning purposes if the business is to be retained for the owner or the owner’s survivors.

- Determine the approximate value of each owner’s interest if the business interest is to be sold.